Get the free ct3t

Get, Create, Make and Sign mass ct 3t form

How to edit massachusetts form ct 3t online

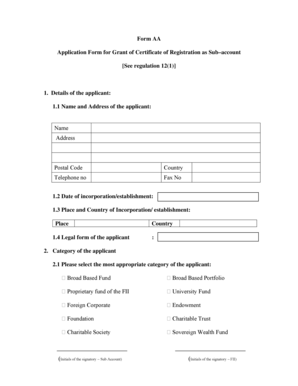

How to fill out form ct 3t massachusetts

How to fill out Massachusetts form CT 3T:

Who needs Massachusetts form CT 3T:

Video instructions and help with filling out and completing ct3t

Instructions and Help about ma formct 3t

Laws dot-com legal forms guide form ct3 general business corporation franchise tax return New York Business Corporations can file their state franchise tax owed with a form ct3 this document is found on the website of the state's Department of Taxation and Finance step 1 give your employer identification number file number business phone number trade name legal name the state or country of your incorporation and the date of your incorporation foreign corporations should give the date on which the began operations in the state step 2 give your NAILS code number and a brief description of your primary business activity step 3 indicate with a check mark if you operate it in an area subject to the MTA tax if so you must also file Form ct3 m4m step 4 answer the questions on lines B through H step 5 lines 1 through 25 provide instructions for computing your entire net income base step six lines 26 through 41 provide instructions for computing your capital base step 7 lines 42 through 71 provide instructions for computing your minimal taxable income base step 8 line 72 through 93 provide instructions for computing your tax do if claiming credits against the current year's franchise tax on line 79 skips to the fifth page and complete lines 100 a and 100 be if documenting prepayments already made complete lines 101 through 106 and transfer the result to line 85 step 9 transfer the balance due from line 93 to line an on the first page step 10 lines 94 through 99 be concerned credits and refunds for overpayments made step 11 lines 108 through one 11 concern income paid to shareholders complete the rest of the form as instructed sign and date the bottom of page eight to watch more videos please make sure to visit laws dot-com

People Also Ask about mass state cig lic renewal form ct 3t

Why can't you ship cigars to Massachusetts?

Do you need a license to sell tobacco in Massachusetts?

What is Massachusetts tax on cigarettes?

Can I ship cigars to Massachusetts?

Can tobacco be shipped to Massachusetts?

What is the form CT RL for Massachusetts?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form ct 3t directly from Gmail?

Where do I find ct3t form?

Can I create an electronic signature for the ct3t form in Chrome?

What is form ct 3t renewal?

Who is required to file form ct 3t renewal?

How to fill out form ct 3t renewal?

What is the purpose of form ct 3t renewal?

What information must be reported on form ct 3t renewal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.